NYC’s real estate market is providing clarity again.

Ariel Property Advisors

Many seem keen to ring a death knell for New York City’s commercial real estate sector, but recent transactions are providing clarity and short-term positivity.

There are, of course, a few headwinds delaying a return to normalcy right now. The city’s COVID-19 positivity rate has ticked upward and the holiday season could exacerbate the rate of spread. The city’s economy is also not operating at levels of full confidence, while vacancy rates and collections are still not up to pre-pandemic levels.

Still, recent transactions have a lot to tell us about what to expect in 2021.

New Investments

On the high end, KKR and Dalan Management purchased an $860 million new construction portfolio in Brooklyn, representing a healthy $573 per square foot and north of $600,000 per unit. This investment follows our belief that Brooklyn has been holding up extremely well during the pandemic. This new construction asset enjoys a property tax abatement and while Brooklyn is still experiencing the COVID-19 vacancies, it is expected to bounce back shortly after.

In Manhattan, though vacancy rates are high below 96th Street, a notable multifamily transaction for 400 East 58th Street revealed a healthy investor appetite. A&E Real Estate Holdings purchased the property from SL Green for $62 million, with the asset including a mix of free market and rent-stabilized units in a prime Midtown location.

Ariel Property Advisors

In the office market, occupancy is low, but well-located assets are trading at premium pricing, as evidenced by RFR’s purchase of JP Morgan’s $350 million Midtown office property, representing $942 per square foot, according to condo filings with the City.

MORE FOR YOU

These three transactions are examples of smart, experienced and visionary sponsors with clear conviction and strategic business plans for the assets. They also indicate that investors with capital see a rare short-term buying opportunity to acquire high-value assets during a narrowing window of slowdown pricing.

The affordable housing market shows a similar dynamic. The Real Deal reported that The Related Companies is in contract to purchase a project-based Section-8 portfolio for $435 million, what would be the largest multifamily transaction in 2020. Additionally, two local operators recently purchased Bronx multifamily properties at 756 Fox Street and 425 Claremont Parkway for $4.2 million and $5 million respectively. Affordable housing benefited through the pandemic from high collection and low vacancy rates—and investors have responded to the asset class’s protection from market exposure.

New Debt Players

Ariel Property Advisors

New private lenders have entered the arena while new capital allocations are being added to existing New York City platforms. For example, New York-based real estate private equity firm Northwind Group launched a $220 million debt fund this summer. In addition to originating loans for acquisition and construction, the fund helps sponsors with financing for condo-inventory loans, distressed assets and non-performing loans. A number of family offices and smaller funds are actively in discussions about unique preferred equity structures.

Overall, both debt and equity capital are flowing more freely today and a clearer path is being laid for forbearance practices. Lenders today can separate special situations (like a global pandemic) from an asset’s ability to collect rent.

More Certainty, New Baselines and Pricing Visibility

Collections and vacancies have stabilized as of September and this new baseline provides further rent visibility. In addition to recent investment transactions telling a story for future deals, this certainty on fundamentals can lead to better pricing visibility and investor confidence. Further clarity on the results of the federal elections and multiple vaccines showing promise, with potential FDA Emergency Use Authorization in the very near future, mean that confidence can beget more confidence.

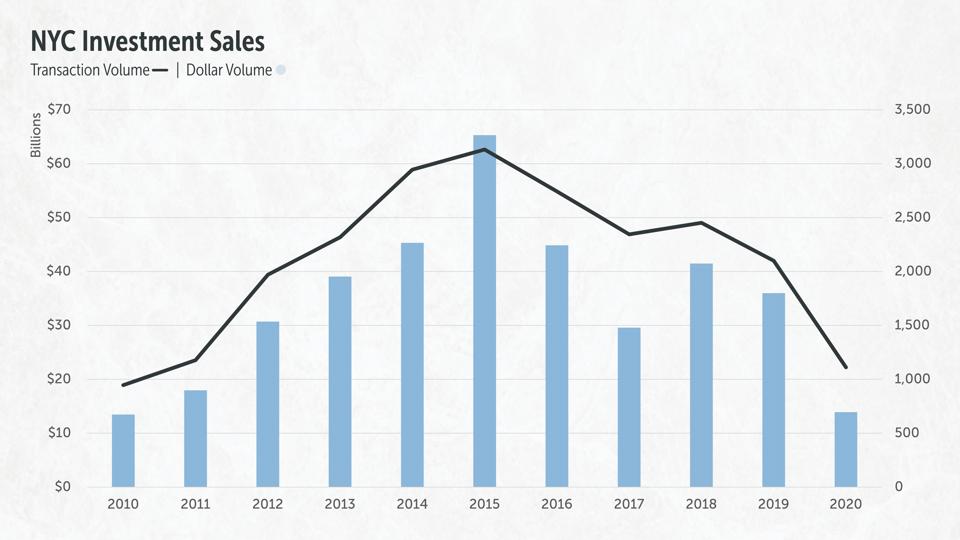

Historic NYC investment sales data from 2010-2020

Ariel Property Advisors

Looking at a historical chart of transaction volume for New York City, the trend shows that a recovery typically follows the lowest reported figures fairly quickly, and looking at property performance within the city shows that fundamentals are very much stabilizing for now.

The volume of rent collections for rent-stabilized units is coming in high and expected to stay that way, a robust and welcome signal as landlords work to stay atop necessary building maintenance. Once the eviction moratorium expires, we can expect these rent collections to surpass today’s levels.

This is still the early stages of the recovery, but the data is encouraging in New York City’s commercial real estate arena. With distress starting to clear, 2021 should see lenders and owners making more moves and selling properties that are underperforming or over-leveraged. With more certainty around the biggest issues within New York City and the nation, fundamentals stabilizing and capital rearing to go, it is time to place your bets.