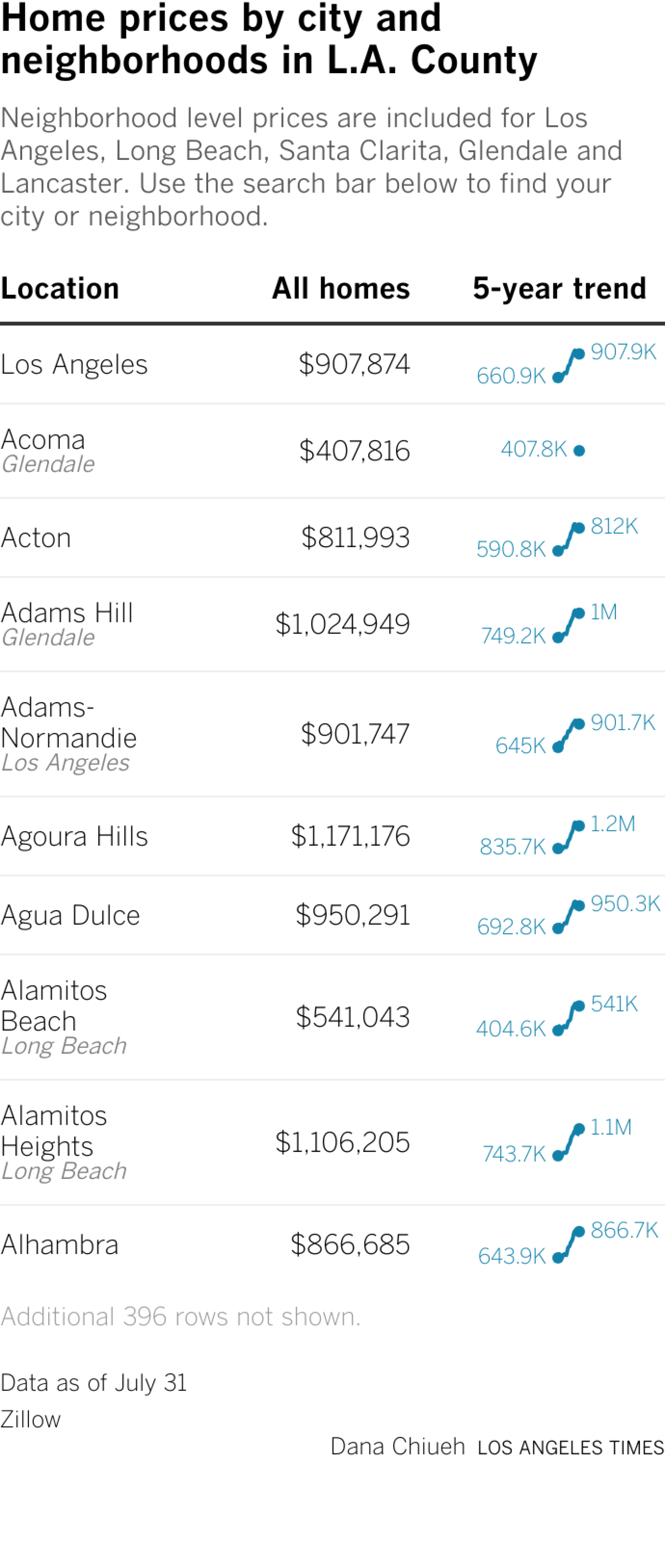

After falling through the second half of 2022, Southern California home prices are rising again.

In August, the average home price across the six-county region was $829,416, according to data from Zillow. That’s up 0.58% from the prior month, and the sixth straight month of increases.

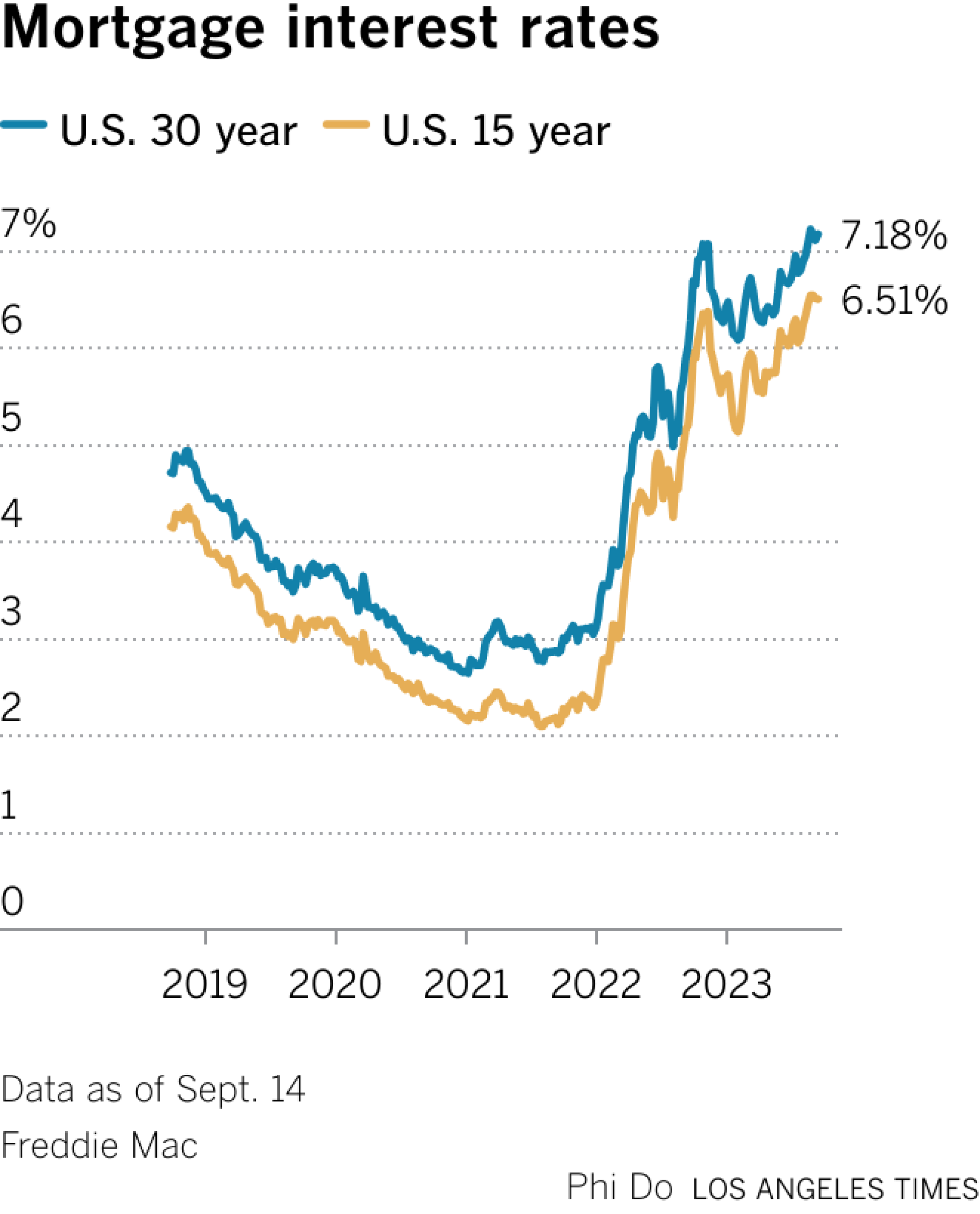

Prices fell last year after mortgage rates more than doubled and suddenly sapped the purchasing power of buyers.

But prices resumed their climb in the spring thanks to a newer byproduct of high rates: an extreme shortage of homes for sale.

Note to readers

Welcome to the Los Angeles Times’ newly launched Real Estate Tracker. This page will be updated every month with data on housing prices, mortgage rates and rental prices. Our reporters will explain what the new data mean for Los Angeles and surrounding areas and help you understand what you can expect to pay for an apartment or house.

Many would-be sellers are now choosing to stay put, not willing to swap their 3% and below mortgages for a loan with an interest rate more than double that.

At the same time, real estate agents say buyers — especially first-timers without a mortgage — have been more willing to return to the market, deciding rates aren’t about to drop much if they continue to put off what they’re eager to do: buy a home.

The supply-and-demand mismatch has driven up prices, but the market is far slower than during the pandemic boom, since high rates still present a hurdle to buyers.

August’s average home price across the Southern California region remains 1.5% below the June 2022 peak.

What happens next depends on a variety of factors, including the direction of mortgage rates and the overall economy.

In recent weeks, mortgage rates have shot up, surpassing 7% for the first time since last fall. If rates stay there or climb higher, that could sap demand enough to send prices down.

But if higher rates convince another wave of homeowners not to list their homes, prices may keep right on climbing.

Other housing stories

Explore home prices and rents for August

Use the tables below to search for home sales prices and apartment rental prices by city, neighborhood and county.

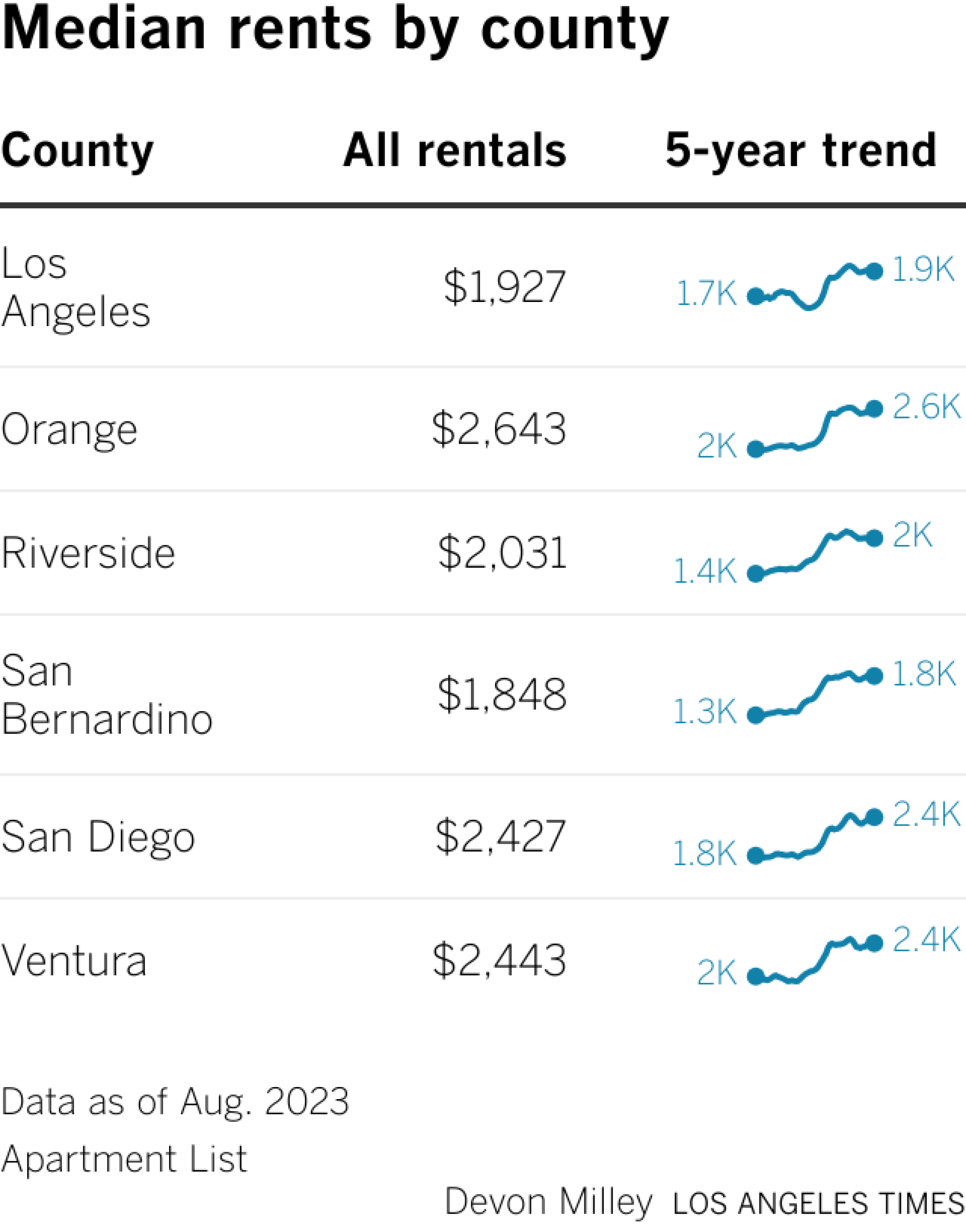

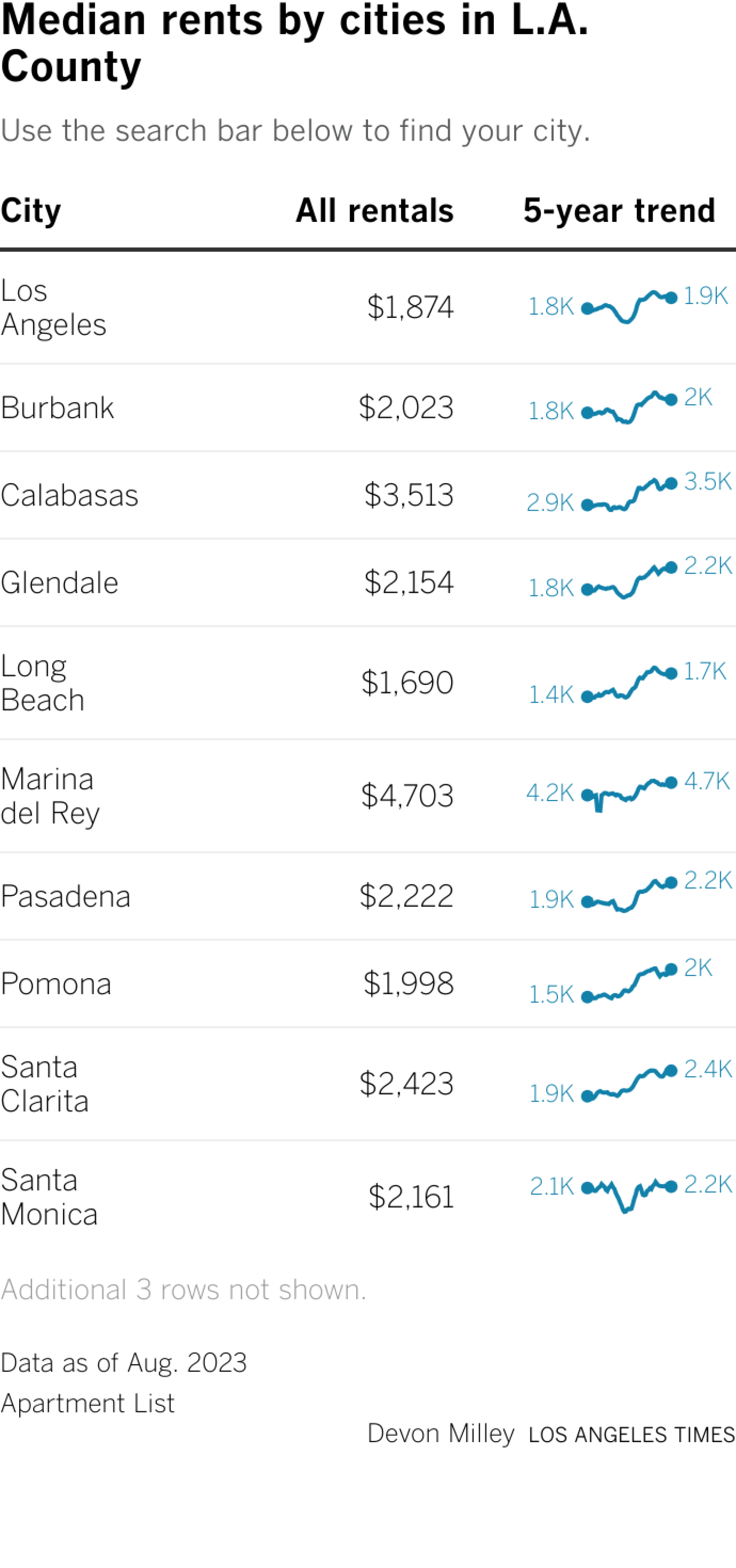

Rental prices in Southern California

In recent months, asking rents in Southern California have ticked down, providing at least some relief for frazzled apartment seekers.

Experts say the trend is driven by a rising number of vacancies across the region that have forced some landlords to accept less. Vacancies have risen because apartment supply is expanding and demand has dipped as consumers worry over the economy and inflation.

The large millennial generation is also increasingly aging into homeownership, as the smaller Generation Z enters the apartment market.

Prospective renters may not want to get too excited, however. Rent is still extremely high.

In August, the median rent for vacant units of all sizes across Los Angeles County was $1,927, down 2.4% from a year earlier but 10.4% more than in August 2019, according to data from Apartment List.