NYC is coming back in a big way.

Ariel Property Advisors

As New York’s residential market heats back up amid the easing of commercial restrictions and lower Covid rates, questions remain about what the recovery will look like and how soon investors can expect the market to return to pre-pandemic levels or higher. Much of this increased demand is due to a sooner-than-expected return to relative normality for New York residents. All the reasons people love New York are getting back into full swing, from theater, museums and music to restaurants, bars, comedy clubs, as well as unique experiences like cruises around Manhattan, archery lessons in Gowanus, distillery tastings in Red Hook, just to name a few. Events are back as well, such as the Tenement Museum’s recent Reopening Party on the Lower East Side. Whatever one’s favorite city activities, the excitement about getting back to them is driving residential real estate demand in the five boroughs.

Thus far, the recovery has not looked like previous recoveries. Typically, distressed assets (buildings that are performing below market value) start to sell before better-performing investment opportunities because of the lower prices and less expensive debt, but that has not been the case during the current recovery. Investors are acting decisively across the board.

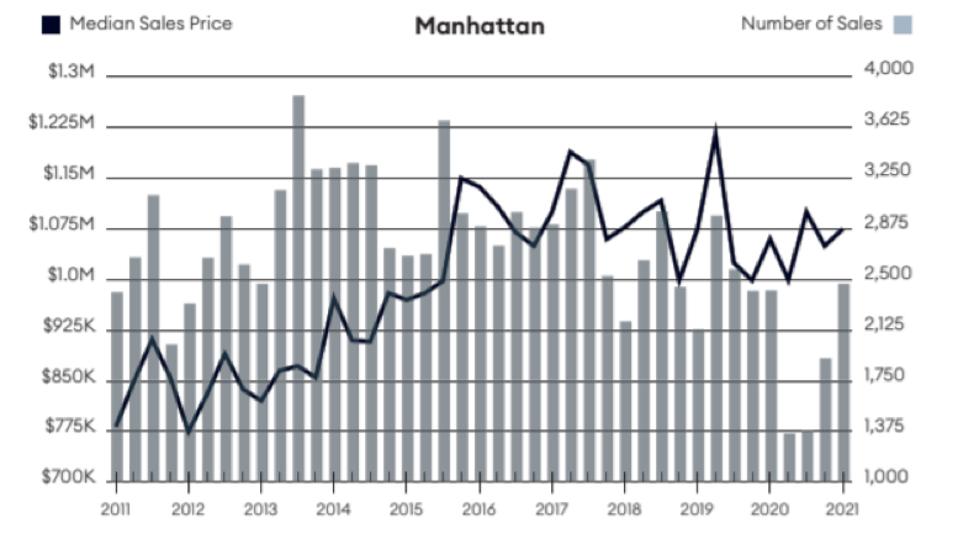

This has been due to solid underlying real estate fundamentals and the downturn being largely the result of the pandemic. However, New York’s residential real estate market was also not entirely rosy before the pandemic either. The city has been in a residential recession since 2016, a prolonged period of reduced activity exacerbated by the HSTPA which impeded landlords’ ability to raise rents and pay for maintenance and upgrades. (See the chart from the Q1 Elliman residential report below.)

Manhattan Sales Data

Elliman

Still, though the HSTPA remains in place, the current market recovery presents investment opportunities for growth. Here’s why:

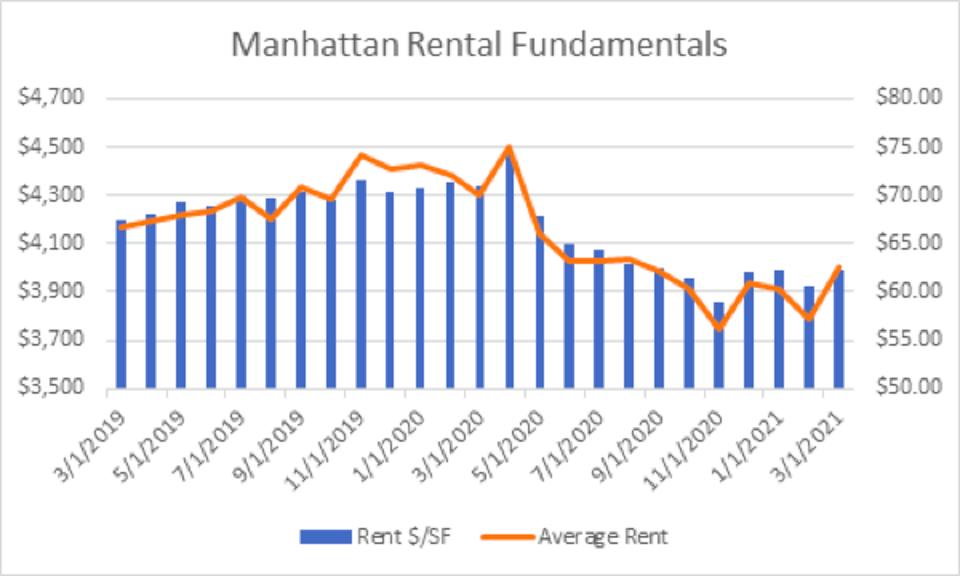

COVID 19 Residential Recovery

The worst is behind us as of the end of 2020. Vacancies are down, which is also causing concessions to be far less ubiquitous in recent months. (Concessions typically involve incentives owners and brokers offer to prospective tenants during a downturn, such as free months of rent, reduced rent and waived fees.) Rental prices are also stabilizing and back on the rise.

MORE FOR YOU

One wrinkle in the rental market is that there’s evidence of more demand for smaller units compared to larger shared apartments. Seemingly, renters are less interested in having multiple roommates and are looking to live by themselves or with just one roommate in the wake of the pandemic. (Relatedly, the profile of renters is also getting younger, due to suburban flight by middle-aged renters and cheaper rents during the pandemic.) As a result, units catering to more shares are showing higher year-over-year discounts. The lingering lower prices on multi-bedroom units may be more attractive to families looking to rent, especially as many families will likely move back to the city with the return of in-person classes in the fall. This trend is particularly pronounced in Brooklyn and Queens, which are highly attractive to families due to lower costs per square foot, less dense environs and more kid-friendly open spaces.

Manhattan Rental Fundamentals

Elliman

On the investment sales side, Q1 2021 has shown that the Manhattan market is resurgent, particularly toward the end of the quarter. Anecdotally from brokers, even the luxury and more expensive end of the market has been doing well with some opportunistic buyers. From Ariel Property Advisors’ own multifamily data, overall contract execution across the multifamily sector during the first quarter increased significantly, which implies a higher volume of transactions to be expected throughout 2021. While this is partially due to the drop in prices, it still speaks to investor confidence in the long-term strength of New York City.

The question now is just how quickly rental and sales prices can recover—and how high they can go this time. Back-to-work policies will be a major factor. Many prominent firms have mandated employees to return to the office full-time or at least in a hybrid work-from-home capacity, but it remains to be seen how many small- to mid-sized companies will return or, in the long term, renew their leases over the next several years.

It is true that some people, particularly parents, may find that working from home in the suburbs, the coast or the country is easier, but it is a foregone conclusion that younger professionals will want to be in the city, especially now as the city’s myriad activities and cultural offerings are back on track. Families are anticipated to return to New York with the resumption of in-person school, but how many still remains a question. This will impact the residential market and there are no clear answers at present.

Supply Constraint

Residential rental development and deliveries of new residential units have gone down drastically since the heights of 2015. A major pre-pandemic factor affecting the residential market continues to be the unintended yet inevitable consequences of the HSTPA on free-market pricing. The housing law removed incentives to keep the assets from depreciating in quality and value, as well as prevented rent-stabilized units from becoming free market, as was the norm previously. As a result, this has lowered the amount of available free market units overall and driven free market value higher than it otherwise might have been, which means less accessibility for middle-income renters.

Meanwhile, the property tax abatement 421A (known as Affordable New York), is about to sunset in the middle of 2022, with no solution or guidance on what will replace it. Essentially, the law provides tax exemptions for new residential construction that delivers affordable components for low- and moderate-income tenants. Without a clear and predictable tax abatement, there is much less economic viability to develop rentals in New York City, especially buildings with significant affordable components. The lack of guidance on tax abatements will likely cause reduced residential rental development to persist in the near term.

Investor Appetite

Despite this lack of clarity for new development, notable investors have shown an increasing appetite for multifamily properties over the past several months, from small- and mid-sized offerings to mega-deals. Some examples include 196 Elizabeth St & 240 Mulberry St in Nolita, which just recently sold for $17.8 million, signaling renewed confidence in Lower Manhattan, while 85 Jay Street in Dumbo is in contract for $220 million and 15 Park Row in the Financial District recently sold for $142 million. In a blockbuster deal, Moinian Group is acquiring SL Green’s 20% stake in the Sky Apartments at 605 West 42nd Street for a $858.1 million valuation.

However, if history is any evidence, growth is accelerated following a crisis because there are lower interest rates and prices are more attractive to investors. New York, which has been historically attractive to investors and is already showing signs of rapid rebirth, is likely to help lead the country’s recovery, even with headwinds from the HSTPA and Affordable New York. Cities like Nashville and Denver are seeing aggressive growth, and in New York City, even sustained mid-digit rental growth will go a long way to creating happy investors.

A number of ancillary market trends will likely further drive New York’s residential recovery. Tech companies are continuing to take office space in the city while life sciences expansion continues, meaning a growing workforce is going to need somewhere to live. In turn, living in New York is one of the primary reasons these firms want to come to the city in the first place. Additionally, campuses will fill up with students this fall when classes resume. This not only bodes well for student housing but the residential market as well, as New York offers many inducements to stay after graduation.

Those incentives are bringing back people who left during the pandemic. While it was buzzy to say that New York was dead during Covid, the smart long-term bet was always on the city’s comeback and the first half of 2021 is bearing that out. Investors, meanwhile, are taking note, because the five-year outlook is overall bright, though investors do need to take note of how public policy may impact their bottom line over the next few years.