A Look At NYC’s Multifamily Investment Sales Across The Boroughs

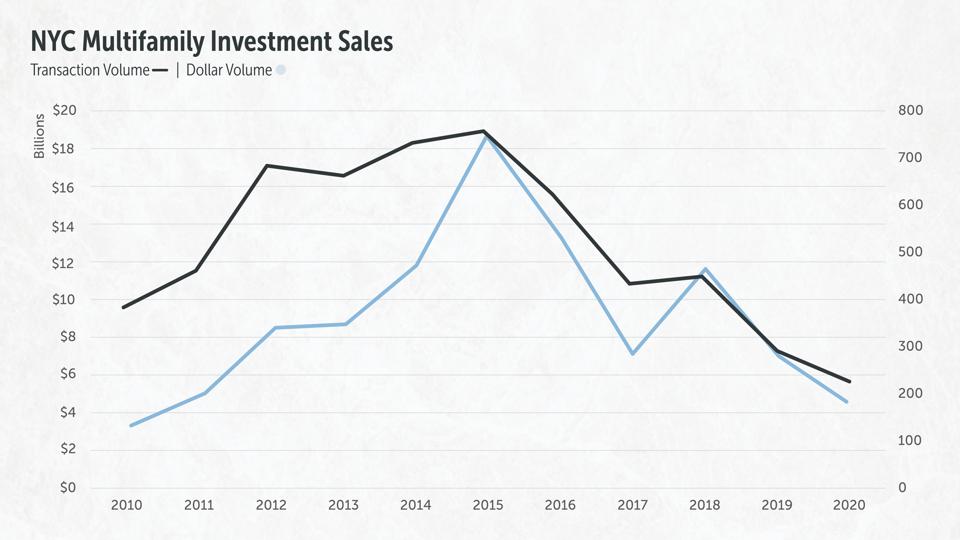

NYC Multifamily Investment Sales, 2010-2020

Ariel Property Advisors

New York City’s 2020 commercial real estate market, like many industries across the nation, felt the economic ramifications of the Covid-19 pandemic. A market already hurting from the HSTPA was halted by the New York On Pause order, which forced retailers, restaurants, entertainment venues and hotels across the city to close their doors or operate at reduced capacity. Many small businesses were unable to pay rent and residential vacancies rose above 5% in Manhattan, according to CNN. These factors influenced lenders to underwrite more conservatively and require additional reserves. Added to these headwinds, the presidential election brought further uncertainty.

NYC multifamily trends for 2020

Ariel Property Advisors

According to year-end research from Ariel Property Advisors, New York City’s multifamily market recorded its lowest dollar and transaction volumes in the past decade and the city grossed $4.51 billion across 232 transactions that consisted of 424 buildings. Compared to 2019, this was a 36%, 21% and 12% decline in dollar, transaction and building volume, respectively.

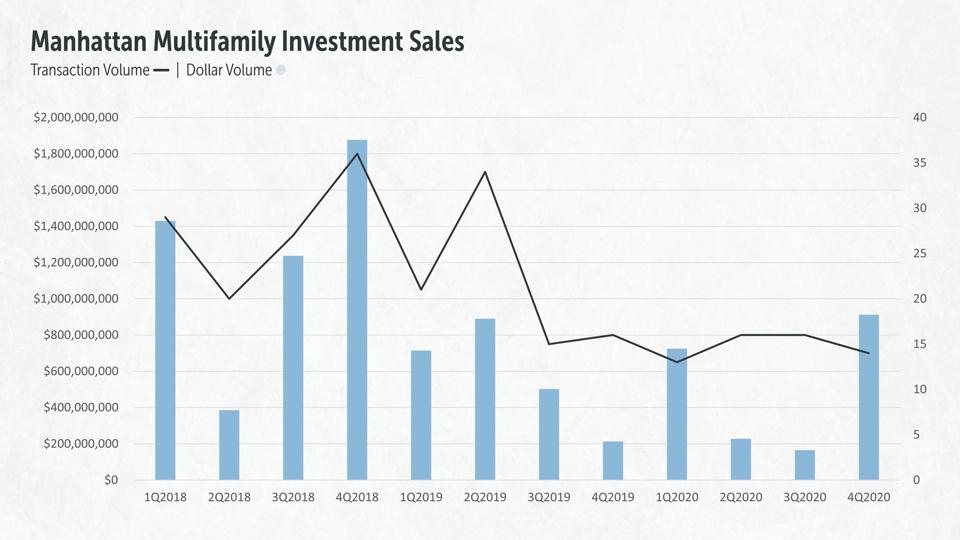

Manhattan Below 96th

Manhattan Multifamily Sales, 2018-2020

Ariel Property Advisors

Manhattan achieved the highest multifamily sales dollar volume, accounting for 48% of New York City’s total dollar volume. The submarket recorded $2.09 billion sales in 2020 across 62 transactions comprising 127 total buildings. Compared to 2019 sales metrics, these totals show a 10% decrease in dollar volume, a 28% decrease in transaction volume and a 19% increase in building volume.

MORE FOR YOU

In addition to fewer transactions, a decline in pricing metrics was further evidence of a softening market. Significantly, the average price per square foot dropped from $929 to $624 and the average price per unit fell from $740,996 to $496,216.

Manhattan’s largest transaction of the year was The Related Companies’ $424 million purchase of 265-267 Cherry Street from a joint venture between the CIM Group and L+M Development Partners. 265-267 Cherry Street is a 492-unit Section 8 building that spans 657,592 square feet at $644 per square foot and $861,702 per unit.

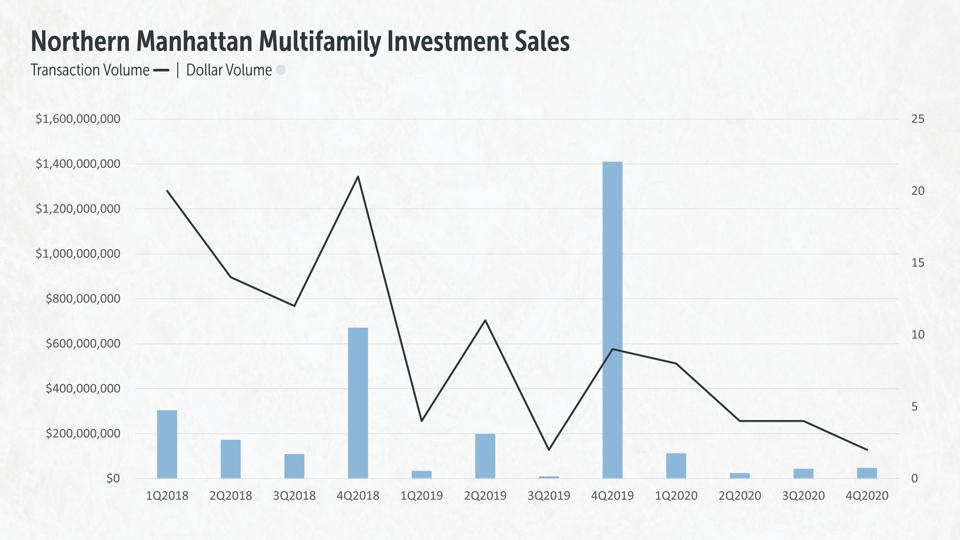

Northern Manhattan

Northern Manhattan Multifamily Investment Sales, 2018-2020

Ariel Property Advisors

Northern Manhattan witnessed the steepest decline in dollar volume year-over-year. The submarket recorded $237.8 million in sales across 19 transactions, an 86% decline in dollar volume and a 27% decline in transaction volume. Keep in mind, though, that these numbers are skewed by the $1.16 billion sale of Brookfield’s East Harlem Portfolio in 2019. Without this outlier, dollar volume would have fallen by 52% year-over-year.

The most notable 2020 sale in Northern Manhattan was the Irgang Group Multifamily Portfolio, comprising 14 buildings located in Northern Manhattan and The Bronx, nine of which traded in East Harlem. The Neighborhood Restore Housing Development Fund purchased the portfolio for $74 million and intends to utilize all 235 units in an affordable housing program targeted for homeless individuals. The portfolio traded at $522 per square foot or $314,894 per unit.

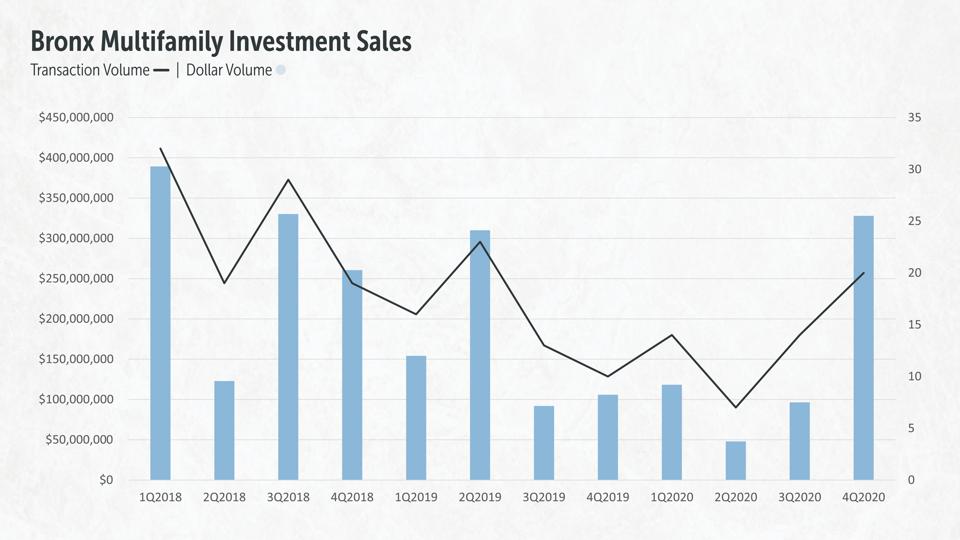

The Bronx

The Bronx Multifamily Investment Sales, 2018-2020

Ariel Property Advisors

The Bronx grossed $599.2 million in multifamily sales for 2020 with a total of 55 transactions. This translates to a 9% decrease in dollar volume and an 11% decrease in transaction volume compared to 2019. While the average price per square foot declined in all submarkets, The Bronx experienced only a modest drop from $196 to $179.

The largest transaction in the borough was Hudson Valley Property Group’s purchase of 1600 Sedgwick Avenue, a 383-unit Section 8 building that sold for $115 million, which works out to $300,261 per unit and $276 per square foot.

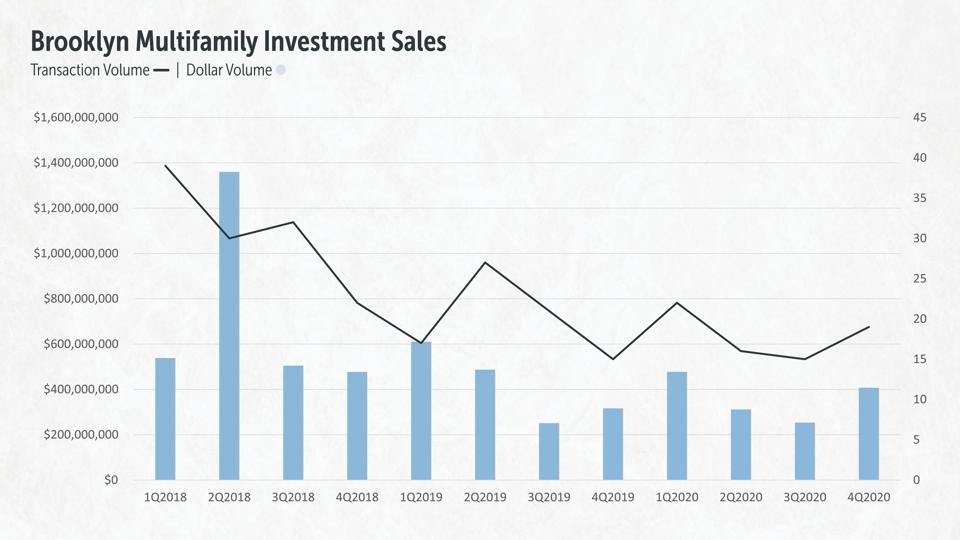

Brooklyn

Brooklyn Multifamily Investment Sales, 2018-2020

Ariel Property Advisors

Brooklyn fared more favorably than the other boroughs, posting the highest transaction volume and the second-highest dollar volume in New York City despite declining sales metrics. The borough grossed $1.35 billion across 71 transactions consisting of 127 buildings. These totals represent only a 19% decrease in dollar volume, an 11% decrease in transaction volume and a 6% increase in building volume. The average price per square foot in the borough dropped slightly from $420 to $388 and the price per unit fell from $381,924 to $335,128.

In the most significant Brooklyn transaction of the year, TIAA-CREF sold 250 North 10th Street to TF Cornerstone for $137.75 million. The 241,764 square foot property, built in 2013, consists of 237 units, which works out to $570 per square foot.

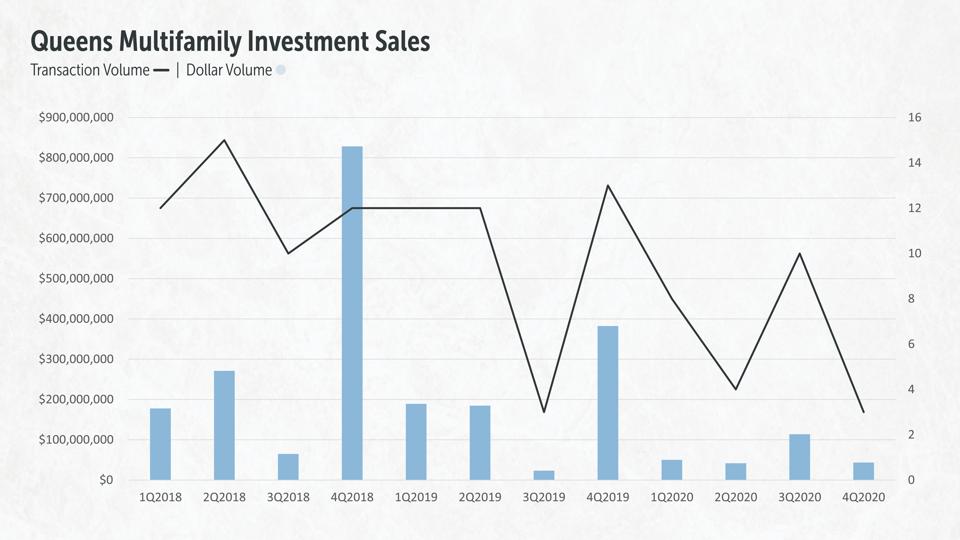

Queens

Queens Multifamily Investment Sales, 2018-2020

Ariel Property Advisors

Queens recorded $230.4 million in sales across 25 transactions and a total of 41 buildings. This is 15 fewer transactions than 2019, which resulted in a 70% decline in dollar volume and a 40% decrease in building volume. The average price per square foot in the borough fell from $342 to $249, a 27% decrease. However, due to the low volume of transactions, the average may not be indicative of actual market sentiment.

The Haight Street Mixed Use Portfolio stood out as one of the most notable multifamily sales in the borough in 2020, selling for $28.1 million. The portfolio consisted of 11 properties in Flushing and comprised 73 units across 77,241 square feet, translating to $364 per square foot and $384,932 per unit.

The Takeaway

The market’s recovery continues to depend on how quickly New York, the US and the world mitigate the threat of Covid-19. As people return to reopened businesses, schools and cultural institutions, the residential and retail markets should benefit from a significant recovery. Lower vacancy rates, continued low interest rates and additional stimulus packages should also provide the necessary momentum for a recovery.