The New York City neighborhood was already popular among residents seeking less expensive alternatives to Manhattan, and the void left by Amazon may be filled by other opportunistic employers.

In the years before Amazon announced it would add up to 25,000 jobs in the area, Long Island City had been establishing itself as a hot and growing housing market. The absence of a new Amazon headquarters is unlikely to change that.

“I don’t see the change in Amazon’s plans as a bad thing for the real estate market in Long Island City,” said local Redfin agent Dave Diedrich. “The area was booming without Amazon and will continue to grow and attract new businesses and residents because of its proximity and easy transit access to Midtown Manhattan, and because of its relative affordability compared with parts of Manhattan and Brooklyn. Nothing is going to stop price growth in Long Island City. If anything, the Amazon deal, the debate it inspired and its cancellation just shines a light on the opportunity the neighborhood offers.”

Other large tech companies including Google and Facebook already have major presences in New York City, and the void left by Amazon in Long Island City may open the door for other businesses to step in. “This presents a great opportunity for another tech company to enter Long Island City, learn from Amazon’s process and bring jobs into the neighborhood. Local politicians also have a chance to learn from the fallout and help other businesses more smoothly go through the process of building a new office in the area,” he said.

For the 90 days following the Amazon HQ2 announcement (November 13, 2018 through February 13, 2019), the median list price for studio and one-bedroom homes in Long Island City were up 22 percent annually to $920,000. In the 90 days preceding the announcement, August 13 through November 12, list prices for the same category of home was $849,000, up 0.5 percent from the year before. The surge in growth in the prices Long Island City sellers asked for likely reflects the enthusiasm and opportunism of some local homeowners looking to cash in on the increased interest from investors Amazon’s announcement drew.

The relatively high list prices in Long Island City can also be explained in part by a surge in new construction. According to data from the Real Estate Board of New York (REBNY), 110 new construction homes were newly listed for sale in Long Island City over the last 90 days, up from 53 during the same time period last year. And in the 90 days preceding Amazon’s announcement, 43 new homes were listed for sale, up from just 8 the year before.

New listings overall are are also up, and they started to rise before Amazon’s HQ2 announcement, too. In October 2018, the number of homes newly listed for sale in Long Island City was up 96 percent since the year before. In November and December they were up 102 percent and 139.5 percent, respectively. (Note that the number of listings in the Long Island City neighborhood is relatively small, so a small difference in listings may have an outsized impact on growth.)

“On the heels of Amazon’s cancellation, homes may start sitting on the market a bit longer—but in the long run, Long Island City will remain desirable because of its proximity to Manhattan, which is still the center of the financial world,” said Redfin chief economist Daryl Fairweather.

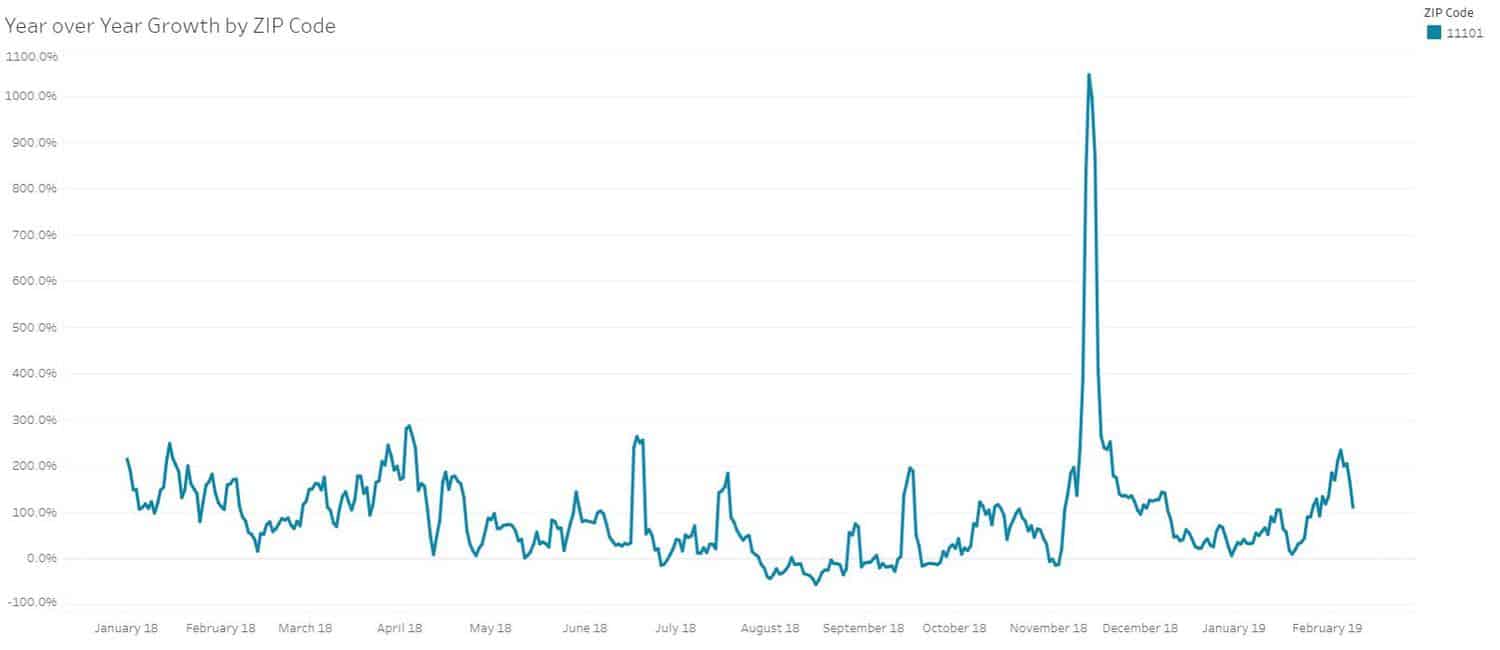

On November 14, the day after Amazon made its HQ2 announcement, online views of homes for sale in Long Island City (zip code 11101) on Redfin.com skyrocketed more than 1,000 percent compared to the same period the year before and Redfin agents reported a jump in calls from prospective homebuyers interested in the area. But in the weeks and months since the announcement, growth in views of properties in the neighborhood settled back down to levels more typical of the last year. The small spike in early February is consistent with fluctuations since the beginning of 2018.

“Interest in the area peaked right after Amazon’s announcement, followed by a pullback and a lull about a month after that,” Diedrich said. “I think the next real boom would have come once Amazon actually started to break ground.”

This post first appeared on Redfin.com. To see the original, click here.