Modern office building close up in sunlight

getty

In this second article of a short series looking at how different real estate sectors are dealing with and adapting to the ongoing crisis, we will be focusing on commercial real estate (CRE). Whilst there have been clear winners over the past few months, such as logistics, and definite losers, such as retail, the office market is somewhere in between. Many of us have become accustomed to working from home and there are grounds to believe that full-time office work could be a thing of the past, but it is unlikely that we will ever stop needing to go to work. After all, humans are deeply social beings and, though the pandemic has taught us to maximize efficiency and has pushed many to discover and embrace remote and flexible work, it is unlikely that this new way of doing things will kill off the office market for good.

There is no doubt, however, that change in the way company and their workers – and consequentially their landlords – approach the office market is accelerating rapidly. In many cases, and similarly to what we saw with the residential space in the last column, change was already underway and COVID-19 has just catalyzed it.

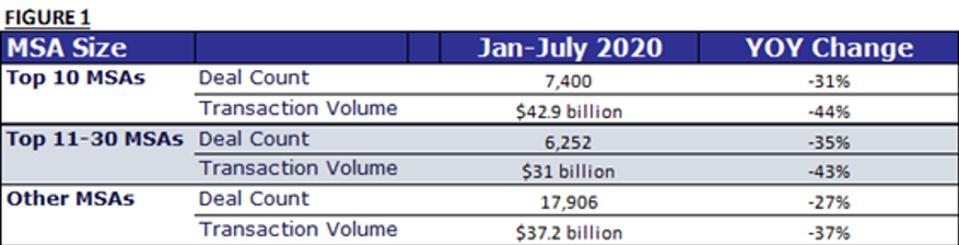

YOY change in deal count and transaction volumes

Reonomy

Reonomy is a New-York based real estate research and data startup. Market analyst Omar Eltorai gave me a bird’s eye view of how the US market is changing. For starters, there has been a dramatic drop off in market activity, in terms of both total dollar volume transacted and total deal count, across all markets. However, the larger markets (which Eltorai defines as the top 30 metropolitan statistical areas, or MSAs, by population) have seen a more severe drop off than smaller markets. Many investors are very cautious about the longer-term implications of trends that have been accelerated by the pandemic and call into question the expectations around the attractiveness of bigger cities with higher costs of living.

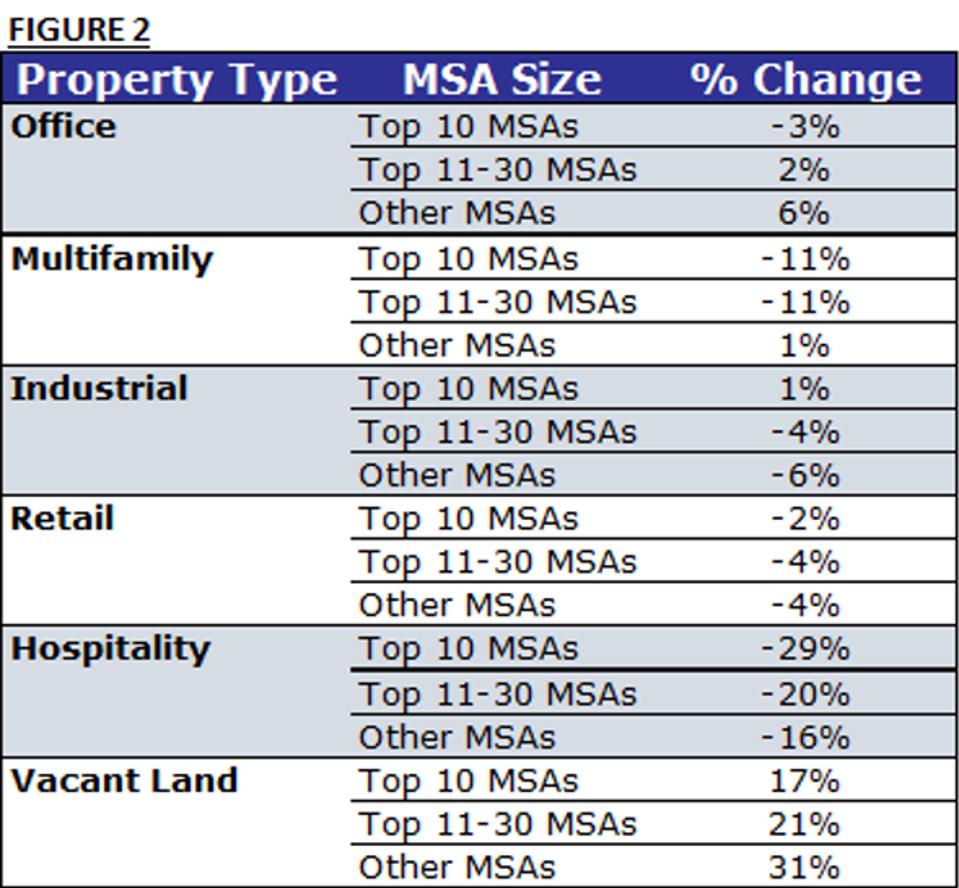

% Change by property type

Reonomy

MORE FOR YOU

Though volumes have taken a hit, Reonomy’s data doesn’t show any significant overall price changes for the office sector. Unsurprisingly, hospitality has been the hardest hit during the pandemic – and this has been exacerbated in the larger markets. Retail and larger market office property values have also been hurt. Though not strictly related to this analysis, Eltorai also shared multifamily data, to highlight that, “while the overall price decline might come as a bit of a surprise, the numbers are showing that the smaller markets have been spared the pain of larger markets, which is supported by the fact that many people have reversed the urbanization trend that has been underway for the last decade or so, and moving to less dense population centers.” Finally, vacant land has performed very well especially in smaller markets; this supports the commentary and news about construction activity picking up in smaller markets across the country, despite the pandemic.

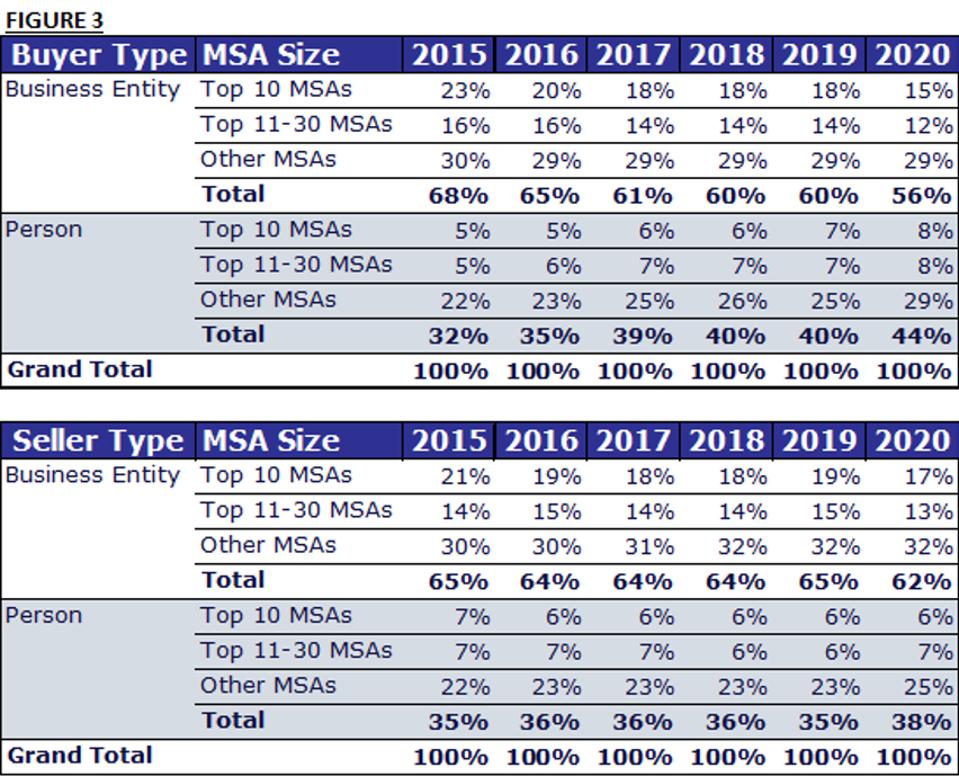

Buyer and seller types per year

Reonomy

Eltorai further noted that “while overall market activity has collapsed in a significant way, we can see that the make-up of the market participants may have something to do with that.” Institutions tend to make up the majority of the market (accounting for over 60% of purchase transactions for the last 5 years, 68% in 2015) but their new-found pandemic-related caution has seemingly decreased their appetite. In 2020, business entities have been the buyer for only 56% of transactions, and they’ve slowed down the most in larger markets.

In this uncertain market, investors’ and asset managers’ reliance on technology to manage portfolios and make informed investment decisions has grown. Oli Farago CEO of Coyote Software, a cloud-based CRE asset management software provider, shared with me that investment teams and asset managers are increasingly using tech to assess how market volatility will impact future investments and to evaluate a portfolio’s exposure to risk in these changing times.

Farago noted that “even before the Covid-19 outbreak, we were starting to see a real shift in the demands from the investor and fund management community on the speed, frequency, consistency, and efficiency of how they manage and interpret their data. The current climate of transformative change and uncertainty, coupled with the inevitable move towards mobile and remote working, is amplifying and accelerating this demand.”

There has been a clear slowdown in CRE market activity since the pandemic started, especially by institutional investors in Tier 1 cities, as they adopt a wait-and-see approach in the current crisis; though prices seem to be holding up for the time being. Within the office space, however, one sub-sector that was already rapidly growing before COVID-19 is now seeing a drastic acceleration in interest: flexible office space, or flex.

Breather is a Montreal-based provider of space-as-a-service which operates on-demand office space across the US and Canada, ranging from small meeting spaces to 13000 square foot fully serviced offices. CEO Bryan Murphy told me that office leasing is down up to 50% (in larger markets such as New York) as occupiers are assessing factors such as when people will be able to return to the office full-time, what the long term impacts of working from home will be and what the lasting effects of COVID will be on businesses.

According to Murphy, “we speak with hundreds of companies each month, and on average they are looking to reduce their office space by 20% post-pandemic. In New York, it costs $15,000 a year to host an employee, and companies are looking to reduce that expense. They are happy to have them work from home, as office space is a top-three expense for most companies.”

Breather’s sales pipeline, and that of other flex providers like it, is at an all-time high as a consequence. Companies facing uncertainty will rather book flex than renew their lease, as the typical lease is 5 to 7 years long whilst the shortest term with Breather is one month.

Before COVID-19, companies were already embracing flex. It currently makes up 2% of the office market and was growing at 50% CAGR pre-pandemic, with forecasts expecting it to reach a 30% share of the market by 2030. Increasingly, even the largest companies will sign a long-term lease for their headquarters, and utilize flex space for their satellite offices which gives them the freedom to scale up or down according to their business needs. This is shift is happening around the world, with the US accelerating and catching up to the UK, the frontrunner in the flex trend.

Murphy reckons that for the next 24 months at least, firms will be reluctant to sign a long-term lease, due to the pandemic and the uncertain economic outlook. Many have let their leases expire and are working from home entirely to cut costs and shore up their future. To serve these companies, Breather has launched its Passport service – an app-based monthly membership program that allows companies to book workspaces for their entire teams to work in together when they need to, at a fraction of what it would cost them to lease a space.

Last but not least, the use of technology in CRE is also accelerating during the pandemic. Similar to what we saw in the previous column, but more so as there are fewer privacy concerns given that it is the workplace and not people’s homes, owners are using technology to increase efficiency in how they manage their buildings. One such example is Livingston-based Logical Buildings, a smart building, and grid-edge energy management software company.

With COVID-19 impacting how many people are in the office, its platform will obtain information about building occupancy from door sensors and other IoT devices, and, drawing upon its data pool on building operations, it will flag if building systems seem to be working too hard. For example, if only 20% of workers are back in the office and temperatures are comfortable, energy use should be low. Assuming real-time utility readings are high, the system would then search for energy waste, such as a compressor that does not have to be on given the current conditions and alert the facilities team. This, and other similar or complementary solutions, are helping owners and operators effectively contain their portfolio costs whilst their staff works from home.

So, how is COVID-19 affecting the CRE market? We only scratched the surface, but a few key trends are clear. Though the office sector is weathering the pandemic storm, for the time being, it will not continue to operate as it once had even when the clouds have cleared. Long leases with large tenants will become increasingly rare, as flexibility takes center stage. Technology will be in the driving seat, both in how spaces will be rented and managed, and how investors look after their portfolios.