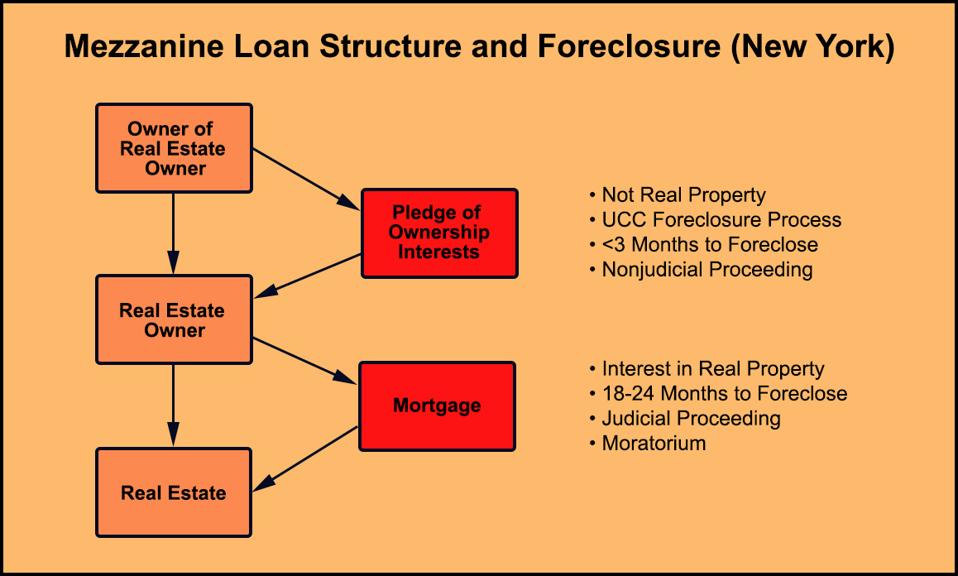

Mezzanine loans are often the riskiest piece of the real estate capital stack. These lenders will suffer the first loss if the value of the collateral goes down. If the loan defaults, they also have the fastest enforcement tool in the foreclosure tool shed: the ability to hold a Uniform Commercial Code foreclosure sale, a process that can take 30 to 60 days.

That’s because the collateral for a mezzanine loan isn’t a mortgage on real estate. Instead, the mezzanine borrower owns the company that actually owns the real estate. That company has already mortgaged the real estate to a mortgage lender. The collateral for the mezzanine loan consists of the mezzanine borrower’s ownership interests in the company that owns the real estate and got the mortgage loan. Those ownership interests are considered personal property, like a truckload of furniture. Foreclosures on personal property move quickly. They aren’t governed by the rules that slow down mortgage foreclosures.

Mezzanine loans offer real estate borrowers a second layer of financing, but the foreclosure process … [+]

Ranjan Samarakone

In today’s wretched real estate markets, mezzanine lenders have started to flex their muscles. If a mezzanine borrower misses a payment and the mezzanine lender wants to foreclose, the lender doesn’t need to give a series of multiple notices, file suit, wait for the borrower to respond and then go through a series of hearings and legal motions – the intricate process that can make a mortgage foreclosure take two years, at least in New York. Instead, the mezzanine lender can notify the borrower that the lender intends to sell the collateral to the highest bidder at a UCC foreclosure sale auction.

The law requires everything about that sale to be “commercially reasonable.” So a mezzanine lender will need to do a commercially reasonable amount of advertising of the sale. Potential bidders will need to have commercially reasonable access to documents and information on the underlying property, and perhaps tours of the property. The mezzanine lender’s entire sales process must be commercially reasonable.

A few mezzanine lenders have tried to hold UCC foreclosure sales during today’s pandemic. These efforts have sometimes triggered litigation in which the mezzanine borrower challenges the specific procedures for the sale. Mezzanine borrowers have also argued it’s unreasonable per se to try to hold a mezzanine foreclosure sale during the pandemic, because it’s so difficult to actually stage an auction with bidders.

In a New York case decided in May, the court temporarily blocked a mezzanine lender’s foreclosure sale, but then heard further argument. In a brief decision, the court allowed the sale to proceed. The borrower argued the sale could not proceed because of the Governor’s order blocking mortgage foreclosures. The court decided a UCC sale wasn’t a mortgage foreclosure, but didn’t address the commercial reasonableness of the sale, or the borrower’s argument that in the current pandemic it’s impossible to have a commercially reasonable sale. Although the borrower argued it would suffer economic loss from the lender’s sales procedures, the court dismissed that concern as “speculative” and let the sale proceed. (D2 Mark LLC v. OREI VI Investments, LLC, Index No. 652259/2020, NY State Supreme Court, New York County.)

A different mezzanine borrower did better in late June. There the lender had given the borrower 36 days notice of the sale, which would be held in a law office or through a virtual/online auction. The successful bidder had to post a deposit of 10% of the purchase price, and pay the balance in 24 hours. Until the lender changed its mind, the borrower was prohibited from bidding.

The mezzanine borrower argued that those and other procedural elements were commercially unreasonable. The borrower again argued that the Governor’s order against mortgage foreclosures precluded the sale. Finally, the borrower argued that the sale breached the “covenant of good faith and fair dealing,” because the collateral value far exceeded the loan amount, and it was bad faith by the lender to foreclose because of one missed payment during a pandemic.

The court ordered the sale postponed by 30 days, to allow for more advertising and more clarity on the sale process. In theory, this also gives the mezzanine borrower some time to find new financing, although it usually takes longer than that even under ideal circumstances. But the court did allow the sale to proceed, despite the pandemic and the Governor’s order prohibiting mortgage foreclosures. (1248 Associates Mezz II LLC v. 12E48 Mezz II LLC, Index No. 651812/2020, NY State Supreme Court, New York County.)

Even though the second mezzanine borrower did better, it still faces a quick loss of its investment because of the speed of mezzanine loan foreclosures.

Mezzanine borrowers have traditionally lived with that risk as part of the cost of obtaining an additional layer of higher-risk financing. Ultimately if a borrower wants to mitigate the risk, the borrower’s principals may need to contribute additional capital so the borrower can bring the mezzanine loan current and keep the lender at bay, at least for the current month. Do the principals want to throw good money after bad every month going forward?

The real estate carnage caused by today’s pandemic may lead future mezzanine borrowers to try to negotiate a kinder and gentler – and above all slower — mezzanine loan foreclosure process if a property gets into trouble. Whether mezzanine lenders will agree to that represents another discussion.