getty

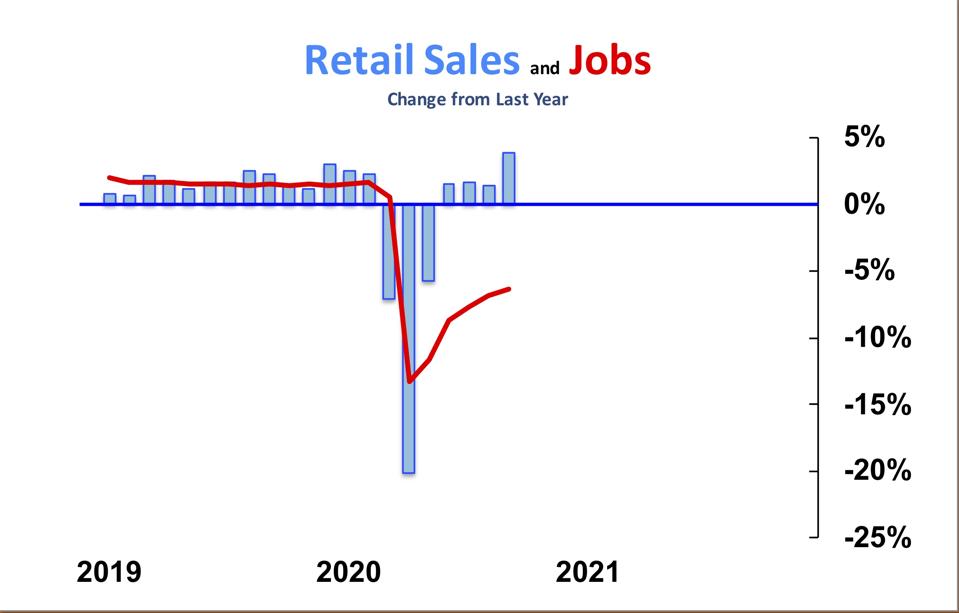

Several things are now pretty clear. First, the recession will last well into 2021. Even though retail spending has bounced back from a 20% drop, jobs haven’t. More government spending will help the 10 million people who have not regained their job, but it can’t give them a new one. As long as Covid is a major presence among us, the people who held those jobs will be in financial trouble.

Second, many people under financial stress who so far have been able to remain in their home, whether a house or an apartment, will end up making other living arrangements. There are about 100 million households in the U.S.—if 10 million have a member who is now unemployed, that’s a sizable portion of the real estate market.

Third, renters are disproportionately affected. While jobs in all sectors of the economy have been lost, they’re concentrated in industries where the pay is low: restaurants, stores, hotels, tourism, teaching. And even in businesses that are doing ok, the switch to remote work or a streamlined workforce, whether permanent or not, eliminates clerks, secretaries, cleaning crews and caterers.

Retail Sales & Jobs (Change from last year)

Local Market Monitor, Inc.

Fourth, rentals will be a very good investment opportunity for years to come. Federal policy will keep interest rates at very low levels, which means both that financing a rental property will be very cheap and that the yield on alternative investments will be poor.

All of this creates a situation where more people will need to rent, but many of them will have trouble paying. At the same time, more investors will vie for rental properties. As a result, the potential rewards for investing in rentals will be good during the next few years but the risks of making a poor investment will also be higher.

With risks higher, investors will need to be more careful. That will be difficult for a while because the best way to be careful is to analyze an investment situation by using facts, and so far we don’t have many facts. We don’t yet know how many jobs will be permanently lost—or where. We don’t yet know what kind of population shifts there will be. We don’t even know how long the pandemic will last.

So, what can an investor do right now? With more competition coming, how can you just sit on the sidelines?

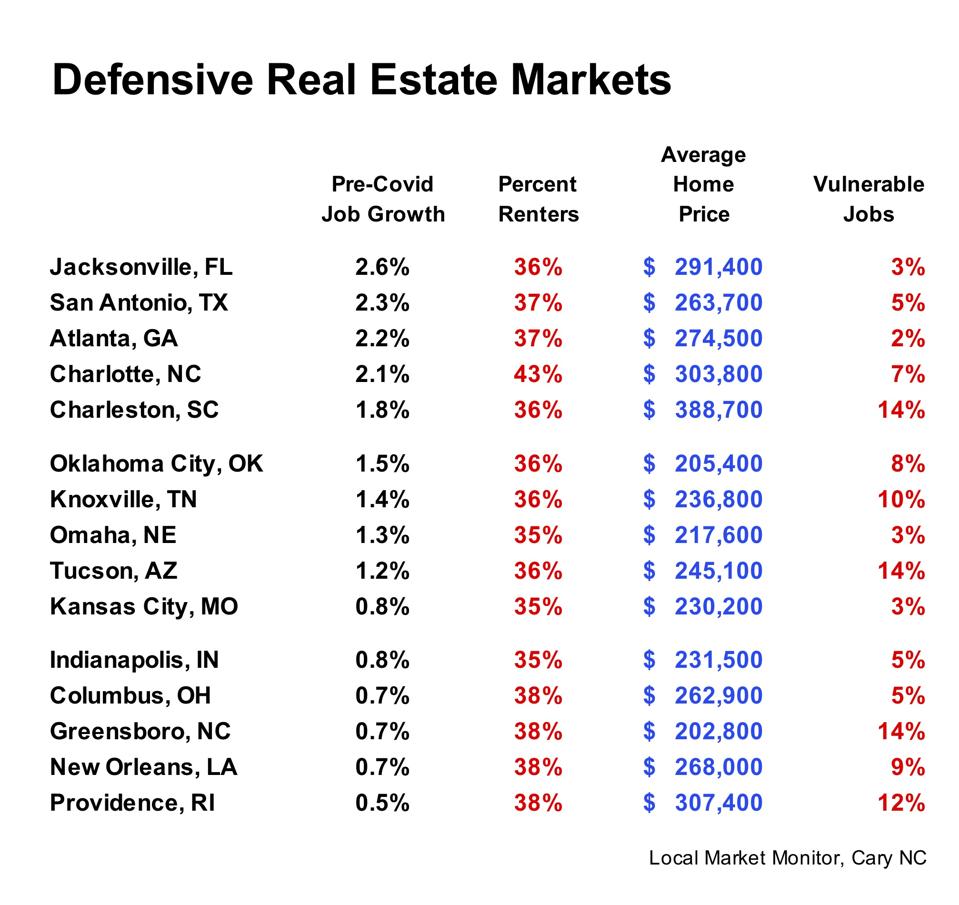

Until we have better facts to reveal better opportunities, investors should take the safest route: Choose larger markets rather than smaller ones; choose markets with a high proportion of renters; avoid expensive markets (San Francisco comes to mind); avoid markets with lots of tourism jobs (Las Vegas).

I’ve listed 15 markets I consider good defensive choices. They’re large, not expensive or over-priced, have lots of renters, and a low percent of their jobs are vulnerable to a long recession or restructuring. They’re sorted by their job growth before the pandemic, maybe that’s how they’ll do afterwards.

The potential rewards for investing in rentals will be good during the next few years but the risks … [+]

Local Market Monitor, Inc.

And, in whatever locality you choose to invest, avoid low-end and high-end rentals, stick to the middle of the rental market. One fact we can be sure of, most tenants move within two years—and in this difficult economic climate, probably sooner. Your risk won’t be clear for a year or two, when your tenant moves out and you need to find a new one. So make sure your property rents are in the middle of the pack, not on the ends.

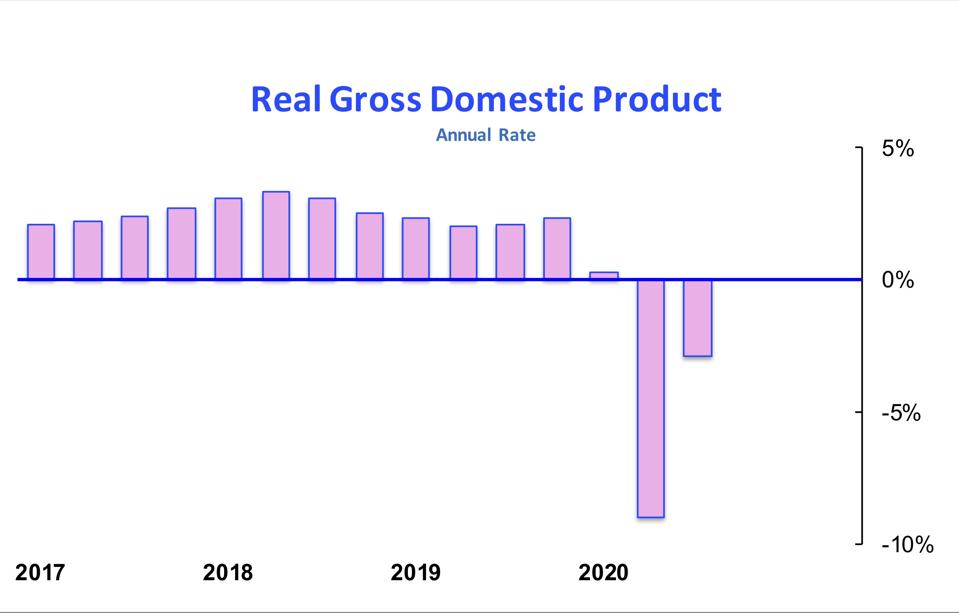

Real GDP – Annual Rate as of November 2020

Local Market Monitor, Inc.

In about a month we’ll have new data on local home prices and a better feel for where the economic chips may eventually fall. This will be a challenging environment for investors but also a time when the base can be laid for a solid long-term property portfolio.