Brooklyn is foundational to NYC’s recovery.

Ariel Property Advisors

On September 22, Industry City’s proposed rezoning and expansion joined Amazon HQ2 in Queens as another major multi-faceted neighborhood development to be scrapped after community opposition and a lack of support from local officials. These reversals of fortune for major developments represent a sea change in local politics, and while some say that this new, more progressive atmosphere spells doom for New York City real estate, this is overblown. As I’ve written before, the smart bet on New York is long. The city economy—and its real estate market—is too strong and too diversified to trend down in the long term.

Still, real estate players are rightfully concerned that big projects with major economic development potential are not able to move forward, especially in Brooklyn.

“Brooklyn is currently the most resilient market in the five boroughs,” says Stephen Vorvolakos, Director of Investment Sales with Ariel Property Advisors focusing primarily on Brooklyn. “After all, to help lead the city—and the country—out of the pandemic-related slowdown, we should leverage the city’s most reliable asset in its strongest borough right now: Brooklyn real estate.”

What makes land and the buildings on top of it valuable is that people want to live in, work at and visit those properties. Also important is that assets offer future upside through the ability to improve on what’s there or to build new structures. Real estate touches nearly every facet of the economy and new activity is crucial to the recovery, especially at a time when typically reliable cashflows from retail, entertainment and tourism are stalled for the foreseeable future.

For big-impact projects that bring substantial income and jobs, property must ultimately present significant upside in value because development costs are substantial, especially in New York, where land is expensive. Design, engineering, labor, construction, legal work and marketing are just some of the many costs that come after the land purchase. The tradeoff in New York is that developments with high demand still have tremendously high value compared to extensive building costs.

If developers can’t develop land to its full economic potential, that can hurt New York’s recovery. New York has the tools with rezoning to incentivize developers to tap into that much-needed value. By rezoning an area to allow more ways to use land and buildings, this removes risk by diversifying the industries in the area, as well as allows developers and owners the ability to attract more—or more strategic—types of tenants. This is especially true at a time during Covid when there’s an ascendant demand for life sciences and while many retail, dining and hospitality spaces are pivoting to meet the growing demand for industrial, warehouse and distribution.

What’s interesting about Industry City is that the rezoning proposal was mainly for retail and hospitality, two beleaguered asset classes, with some academic and community use as well. Community concerns arose about displacement, changes to the character of the neighborhood and whether the new jobs that would come to Sunset Park would actually benefit the current residents.

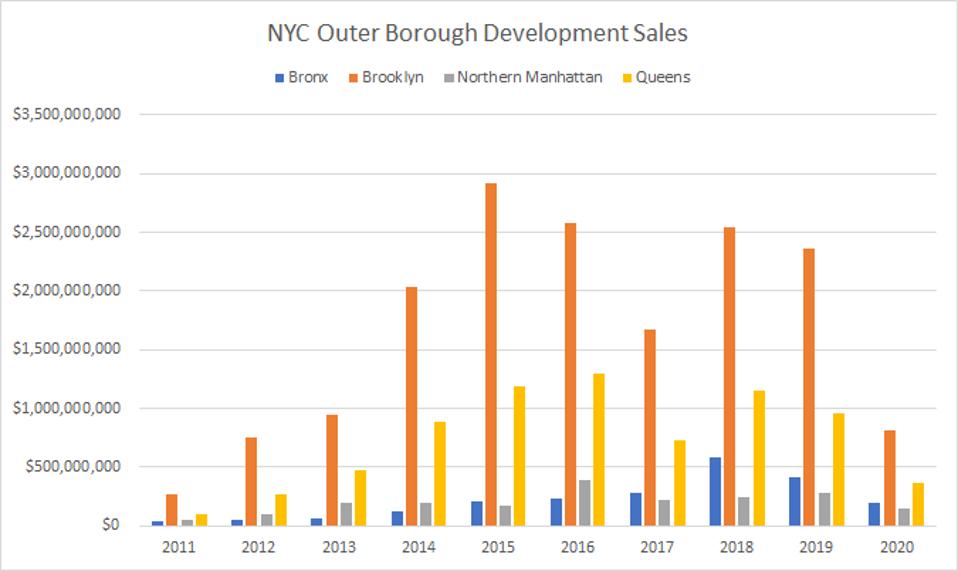

NYC Outer Borough Development Sales

Ariel Property Advisors

Ultimately, the withdrawal of the rezoning proposal hurts everyone, especially because Brooklyn is essential to the City’s recovery. It has the largest population of the five boroughs, and according to my firm’s data from August (shown in the graphic above), it is by far the most active Outer Borough investment sales market at present.

“Numbers are showing that Brooklyn isn’t emptying the way Manhattan is,” says Vorvolakos. “There is a resilient, committed population here and a still-active real estate market. Brooklyn is uniquely positioned to anchor the metropolitan area’s recovery.”

It is imperative that development continue and the City and State incentivize it, including through tax credits, grants and, yes, rezoning. Stalled projects aren’t in anyone’s best interests, and developers and owners, for their part, need to understand the concerns of present-day residents to avoid future Industry City and HQ2 situations. It is incumbent on local politicians to work more closely with communities to drive strategies and proposals that are more likely to move forward by addressing neighborhood economic needs while also providing value for investors and developers. Brooklyn has the valuable land and the space to do both, and we need to keep building there.