Although the number of homes for sale is increasing rapidly in some markets, the number of affordable homes for sale is falling.

We have written a lot recently about rapid growth in the supply of homes for sale in many markets such as San Jose and Seattle. But with both home prices and interest rates up from a year ago, both the number and share of homes for sale that are affordable to a typical household has actually decreased even as total homes for sale are increasing.

For this report we considered all homes that were active on the market at any point in 2018 and 2017. We calculated the share of homes in each metro area that were affordable during each year to a household making the median income in that metro area, assuming a 20 percent down payment, an interest rate of 4.64 percent for 2018 and 3.95 percent for 2017, and a monthly mortgage payment no more than 30 percent of gross income.

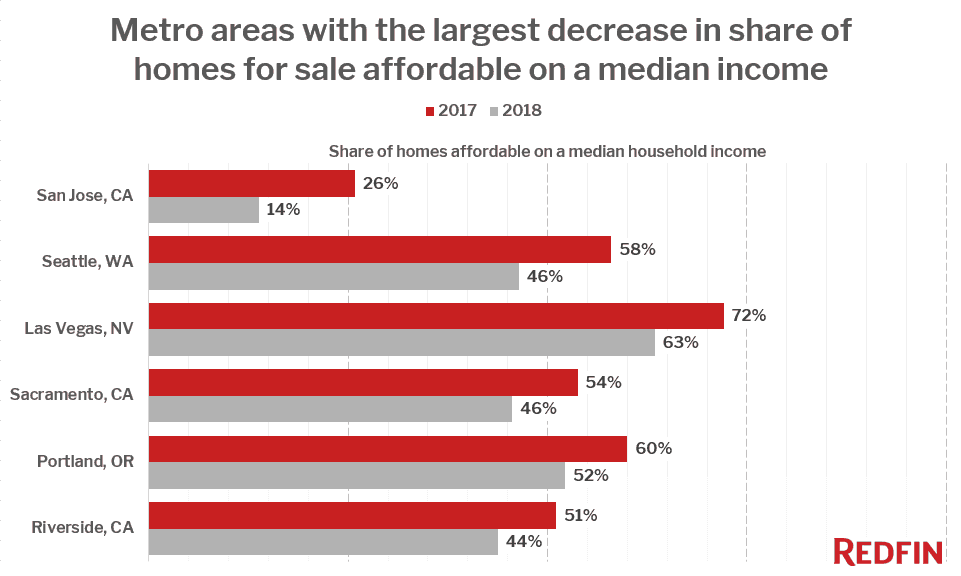

Just 14 percent of homes that were on the market in 2018 in the San Jose metro area were affordable on the median household income in the area of $117,000. This is a big drop from 2017, when 26 percent of homes that were for sale were affordable. In Los Angeles, 16 percent of homes for sale were affordable in 2018, down from 20 percent in 2017. In Seattle the share of affordable homes for sale dropped from 58 percent in 2017 to 46 percent in 2018.

Home price gains and interest rate increases through 2018 combined to considerably reduce home affordability, so even though the number of homes for sale is increasing the number of affordable homes on the market has decreased in most metro areas.

“Homeownership is increasingly out of reach for the typical American,” said Redfin chief economist Daryl Fairweather. “Over the last few years builders have focused on luxury homes, and there hasn’t been enough construction of affordable starter homes.”

In many metro areas, even as the number of homes for sale has increased, the number of affordable homes for sale has shrunk over the past year. In the San Diego area, there were 10 percent more homes for sale during 2018 than 2017, but the number of affordable homes for sale fell 16 percent. In the Seattle metro, there were 4 percent more homes for sale, but the number of affordable homes for sale fell 17 percent.

Although the share of homes for sale that were affordable on a median income fell from 2017 to 2018 in all 49 of the metro areas we analyzed, there were a few metro areas where the number of affordable homes for sale increased, including Hartford, CT (+19%), Jacksonville, FL (+9%) and Nashville, TN (+4%).

Homebuyers looking for affordable options still have plenty of choices in metro areas like St. Louis (84%), Minneapolis (82%) and Pittsburgh (82%). Strong growth in jobs and wages may also help buyers make up some lost ground as well.

“We expect builders to shift their attention to more affordable homes during 2019,” added Fairweather, “which along with rezoning efforts by local governments should reduce this pressure to some degree over time.”

| Table: Number and Share of Affordable Homes for Sale, 2017 and 2018 by Metro Area | ||||||

| Metro Area | Number of homes for sale affordable on a median income (2017) | Share of homes for sale affordable on a median income (2017) | Number of homes for sale affordable on a median income (2018) | Share of homes for sale affordable on a median income (2018) | Year-over-year change in # of affordable homes for sale from 2017 to 2018 | Year-over-year change in total # of homes for sale from 2017 to 2018 |

|---|---|---|---|---|---|---|

| San Jose, CA | 5,804 | 26% | 2,616 | 14% | -54.9% | -15.6% |

| Seattle, WA | 43,837 | 58% | 36,476 | 46% | -16.8% | 4.1% |

| San Francisco, CA | 16,731 | 31% | 13,954 | 26% | -16.6% | 1.0% |

| Los Angeles, CA | 27,257 | 20% | 22,935 | 16% | -15.9% | 4.5% |

| San Diego, CA | 17,833 | 28% | 15,036 | 22% | -15.7% | 9.9% |

| Washington, DC | 170,127 | 74% | 149,208 | 71% | -12.3% | -8.3% |

| Sacramento, CA | 22,667 | 54% | 19,932 | 46% | -12.1% | 3.7% |

| Philadelphia, PA | 160,098 | 79% | 142,338 | 77% | -11.1% | -8.9% |

| Riverside, CA | 38,988 | 51% | 34,721 | 44% | -10.9% | 4.0% |

| Portland, OR | 30,832 | 60% | 27,867 | 52% | -9.6% | 3.9% |

| Baltimore, MD | 81,974 | 80% | 74,268 | 76% | -9.4% | -4.8% |

| Salt Lake City, UT | 19,161 | 77% | 17,582 | 71% | -8.2% | -0.3% |

| Milwaukee, WI | 19,848 | 80% | 18,236 | 74% | -8.1% | -0.5% |

| Memphis, TN | 13,989 | 80% | 12,880 | 76% | -7.9% | -2.6% |

| New York, NY | 127,773 | 50% | 118,318 | 45% | -7.4% | 3.2% |

| Denver, CO | 43,948 | 65% | 40,931 | 60% | -6.9% | 1.4% |

| St. Louis, MO | 47,377 | 87% | 44,262 | 84% | -6.6% | -3.4% |

| Oklahoma City, OK | 24,843 | 84% | 23,272 | 80% | -6.3% | -1.9% |

| Boston, MA | 41,823 | 59% | 39,295 | 55% | -6.0% | 0.5% |

| Raleigh, NC | 25,786 | 83% | 24,242 | 78% | -6.0% | 0.2% |

| Phoenix, AZ | 80,681 | 73% | 76,043 | 69% | -5.7% | -0.2% |

| Birmingham, AL | 15,335 | 76% | 14,506 | 71% | -5.4% | 0.6% |

| Pittsburgh, PA | 28,304 | 84% | 26,855 | 82% | -5.1% | -2.7% |

| Charlotte, NC | 39,700 | 75% | 37,829 | 70% | -4.7% | 1.9% |

| Louisville, KY | 16,828 | 81% | 16,071 | 77% | -4.5% | 0.6% |

| Cincinnati, OH | 28,822 | 85% | 27,543 | 81% | -4.4% | -0.1% |

| Tampa, FL | 53,983 | 73% | 51,817 | 67% | -4.0% | 4.9% |

| Orlando, FL | 38,875 | 72% | 37,521 | 67% | -3.5% | 3.9% |

| Las Vegas, NV | 34,906 | 72% | 33,697 | 63% | -3.5% | 9.7% |

| Cleveland, OH | 28,833 | 85% | 27,950 | 81% | -3.1% | 1.3% |

| Richmond, VA | 20,788 | 80% | 20,224 | 78% | -2.7% | -1.0% |

| Miami, FL | 77,545 | 51% | 75,531 | 48% | -2.6% | 3.4% |

| Columbus, OH | 28,752 | 85% | 28,026 | 83% | -2.5% | 0.0% |

| Atlanta, GA | 166,051 | 75% | 162,068 | 71% | -2.4% | 3.6% |

| San Antonio, TX | 35,864 | 77% | 35,104 | 72% | -2.1% | 4.7% |

| Detroit, MI | 128,879 | 79% | 126,205 | 75% | -2.1% | 3.3% |

| Minneapolis, MN | 64,772 | 84% | 63,474 | 82% | -2.0% | 0.5% |

| Virginia Beach, VA | 27,110 | 81% | 26,568 | 77% | -2.0% | 2.3% |

| Houston, TX | 100,905 | 75% | 99,284 | 72% | -1.6% | 2.4% |

| Dallas, TX | 97,577 | 76% | 96,037 | 72% | -1.6% | 4.0% |

| New Orleans, LA | 12,603 | 66% | 12,439 | 62% | -1.3% | 5.4% |

| Austin, TX | 32,778 | 75% | 32,484 | 72% | -0.9% | 2.3% |

| Kansas City, MO | 35,206 | 84% | 35,267 | 80% | 0.2% | 5.2% |

| Indianapolis, IN | 32,783 | 85% | 33,053 | 82% | 0.8% | 4.3% |

| Providence, RI | 17,985 | 70% | 18,219 | 66% | 1.3% | 8.8% |

| Chicago, IL | 135,695 | 72% | 139,374 | 69% | 2.7% | 6.8% |

| Nashville, TN | 37,430 | 65% | 38,857 | 62% | 3.8% | 7.7% |

| Jacksonville, FL | 27,106 | 76% | 29,413 | 72% | 8.5% | 15.3% |

| Hartford, CT | 14,290 | 89% | 16,973 | 83% | 18.8% | 28.0% |

Methodology

Using MSA-level income data from the US Census Bureau and 30-year fixed rate mortgage data for December 2018 (4.64%) and December 2017 (3.95%) from Freddie Mac, we calculated a maximum affordable mortgage payment for each metro area in December 2017 and December 2018. We then analyzed all home listings that were active on the market at any time during 2018 and any time during 2017, using the list price, HOA dues, property taxes, and insurance, assuming a 20 percent down payment to determine whether the mortgage payment on the home would fall under a 30 percent affordability threshold for the local metro area.

For more information about the survey and its findings, contact Redfin Journalist Services at [email protected].

This post first appeared on Redfin.com. To see the original, click here.