Although the pandemic emptied white-collar offices, sound stages have been a hot ticket as entertainment production keeps rising.

Against that backdrop, plans have been filed with the city for a complex called Echelon Studios, which could help meet growing demand for facilities as the industry starts to ease COVID-19 pandemic restrictions. Once production is back to full speed, companies are expected to ramp up to satisfy the need for content in theaters and on new streaming services.

Soundstages “have been in short supply for a long time,” real estate developer David Simon said. “Occupancy has been at 95%-plus for the last five or six years, and looking forward we don’t see a letup in demand.”

Simon wants to build Echelon Studios on the site of a long-closed Sears store and parking lot built in 1951 on Santa Monica Boulevard, west of the 101 Freeway. Plans call for a studio with five soundstages and support facilities including offices and space for production base camps where trucks, equipment and actors’ trailers are placed.

The previous owner of the 5-acre parcel between Wilton Place and St. Andrews Place intended to build a housing and retail complex, Simon said, but he is betting that a $450-million independent studio renting space to as many as five content creators at a time is a better use for the site because demand for studios is so high.

“Hollywood has long been the favorite” for studios, real estate broker Patrick Amos of CBRE said, in part because its central location amid nodes of the entertainment business such as Culver City, Burbank and Century City. Its fame is also a factor.

“Hollywood still has that kind of cachet of being Hollywood,” Amos said. “It’s more than just a place.”

The movie and television industry has been one of the key drivers of the Southern California economy for generations, but the advent of video-on-demand streaming provoked “an insatiable appetite” for media-oriented real estate such as studios and offices, according to CBRE.

And that’s despite the Los Angeles area ranking as the world’s leader in soundstage capacity with more than 5.2 million square feet of certified stage space, FilmLA data show. Local stages have remained leased during the pandemic; location shoots, which had dwindled to a trickle, are mounting a comeback.

Other developers are also eager to get in on the industry’s clamor for soundstages, which are soundproofed warehouse-type buildings designed for indoor filming and audio recording without interference from outside noises.

The owner of Television City, formerly operated by CBS, announced plans in March to make $1.25 billion worth of improvements to the Los Angeles lot including raising the number of stages to at least 15, from 8, along with production support facilities and offices for rent.

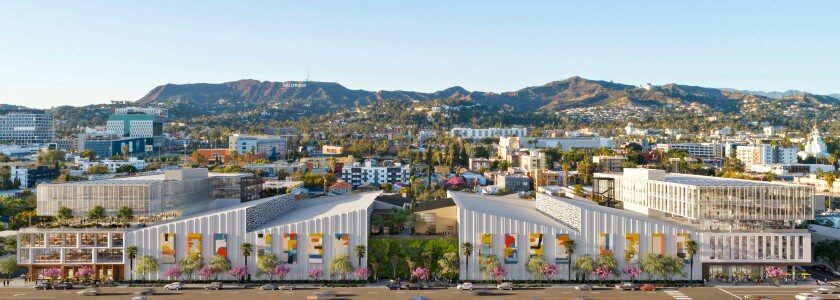

A rendering of the proposed Echelon Studios production complex, which would help fill Hollywood’s need for soundstages.

(Bob Hale / Rios)

New demand for big entertainment-related spaces comes not just from old-line entertainment companies and newcomer streaming services such as Netflix, Apple TV+ and HBO, Amos said.

Improving computerization has opened the market for motion-capture firms that need large, high spaces. Esports companies want big indoor venues for arenas to hold public video game competitions, he said.

“We’re seeing warehouses being converted to stages, modernization of existing facilities and even with that it still seems to not be meeting with the demand,” he said.

Well-known corporate names such as Warner Bros., Paramount, Sony, CBS, Universal and Fox still have the biggest collections of soundstages, but independent players have emerged in recent years with facilities to rent.

Sunset Gower Studios is the largest independent studio in Hollywood with 12 stages. Other large independent players are MBS Media Campus in Manhattan Beach and Santa Clarita Studios in Santa Clarita.

As designed by Los Angeles architecture firm Rios, Echelon Studios would be layered, with underground parking below the soundstages and base camps at street level. On the second level, a cluster of two-story bungalows are envisioned for production companies, intended to evoke the feel of historic studios.

Flanking those elements on the east and west would be two five-story office buildings with a combined total of 350,000 square feet.

The goal is to create “all the things you find on a studio lot,” Simon said, such as writers rooms, executive producers offices, post-production facilities and screening rooms.

Simon sees other opportunities to build in Hollywood, and he has a history there. He was an executive at Kilroy Realty who oversaw that company’s development of the $400-million Columbia Square media campus on Sunset Boulevard that was long home to CBS’ Los Angeles radio and television operations.

He left Kilroy to found Bardas Investment Group, which plans to develop six media and tech-related projects including Echelon with a combined total of 1.2 million square feet. Bardas will begin construction next month on the Bungalows on Fountain, a renovation of an existing office building on Fountain Avenue at Cahuenga Boulevard.

Simon hopes to start work on Echelon Studios in 2023 and open it by 2025.

“What I am trying to do as a business is put together a collection of assets in the heart of the media entertainment district that focuses on the needs of that community,” he said.